Enterprise-grade AI + Data Integration For Insurance

Accelerate partner and agency onboarding. Improve customer acquisition and their end-to-end experience. Streamline claims processing. Do it all using AI + integration.

Accelerate partner and agency onboarding. Improve customer acquisition and their end-to-end experience. Streamline claims processing. Do it all using AI + integration.

Automate and improve processes with the only converged integration platform that lets Insurers combine all the integration styles they need with the full power of AI.

Use 500+ bidirectional connectors or any AP. Automatically turn any data, documents, pdfs, e-mails, and voice into ready-to-use data products that you can easily map to your own internal common data model in minutes.

Combine all integration styles – S(FTP), API integration (iPaaS), ELT/ETL/R-ETL, streaming, and more with support for EDI, ACORD, Xchanging – to automate insurance processes without coding, powered by AI.

Use Nexla’s fully-governed vendor-neutral agentic AI, with support for over 20 LLMs and other technologies, to personalize the customer experience, add self service, or improve claims processing, in minutes without coding.

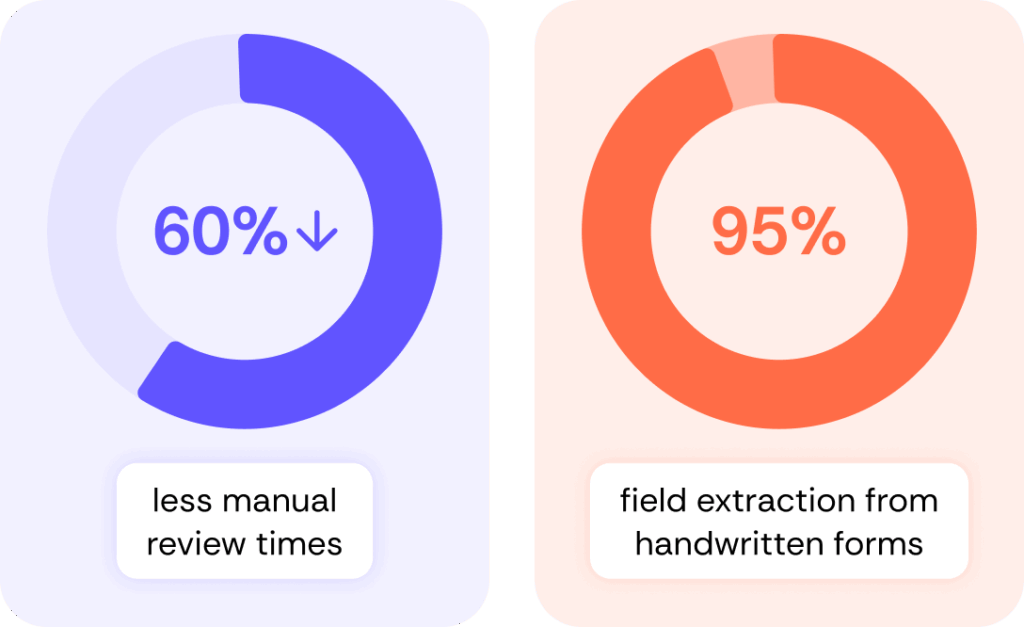

Take any unstructured documents, pdfs, pictures, and voice recordings, and automatically turn them into ready-to-use data products called Nexsets that can be shared and governed across any processes.

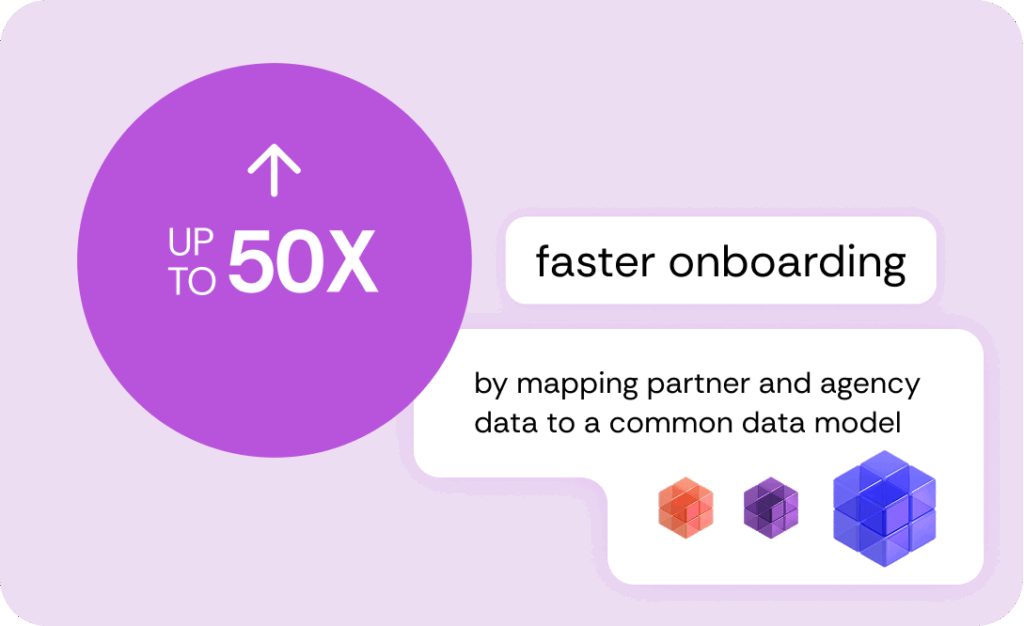

Onboard partners and agencies in hours, not weeks or months. Connect to external data sources, apps, and APIs. Quickly map any external data to your own common data model and integrate with your internal systems without coding for much faster onboarding, time to value, and partner or agency satisfaction.

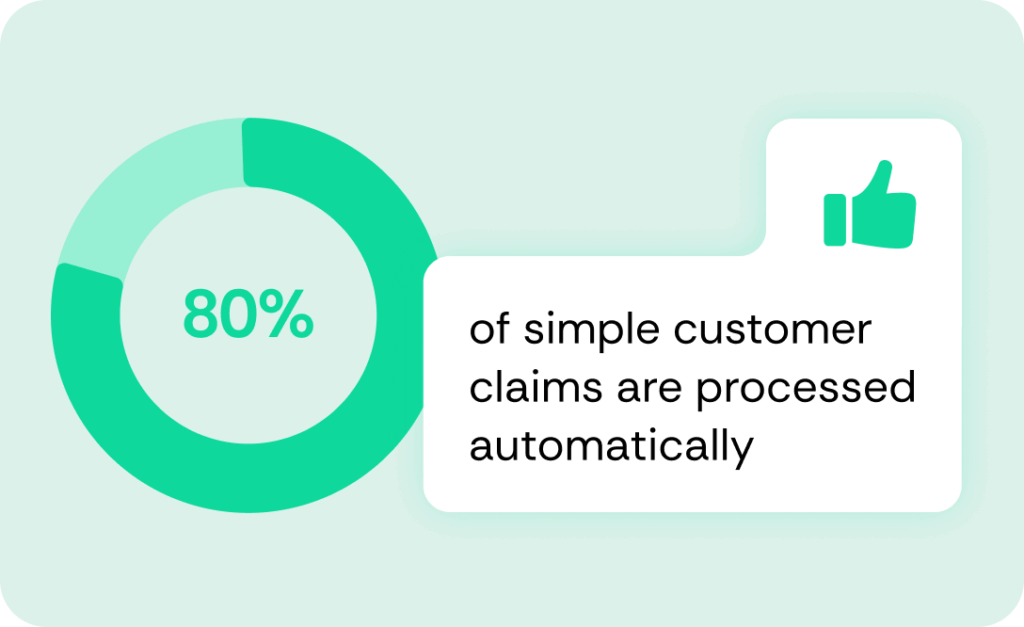

Personalize the end-to-end customer experience. Automate most of the steps involved with customer enrollment, claims submission, and claims processing. Identify cross-selling opportunities. Do it all with no-code AI + integration.

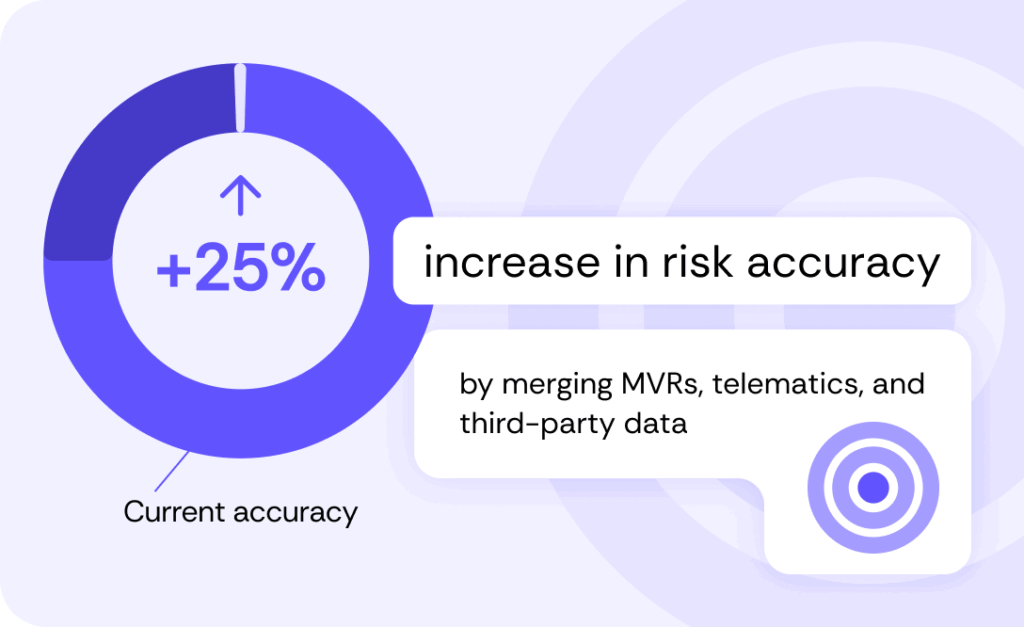

Access and merge all the data you need – motor vehicle records (MVR), telematics, and other 3rd-party data, to get a complete 360 view of risk. Then move the data anywhere and use the latest in ML and AI to continually improve risk assessment.

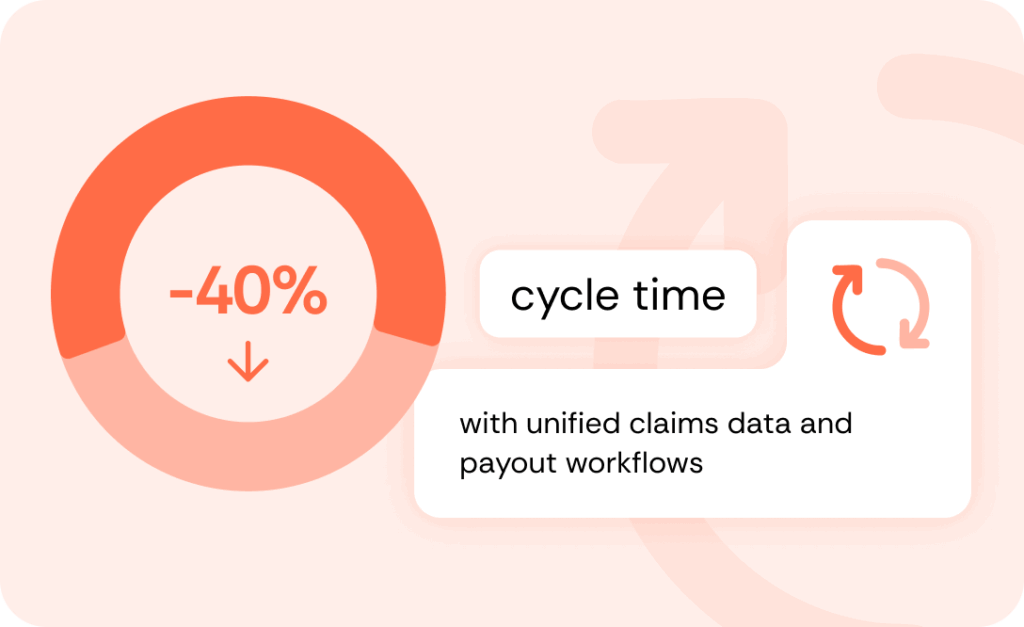

Streamline claims submissions and processing from the first notice of loss (FNOL) to payout by replacing manual steps including reviewing notes and pictures with automation using AI and converged integration.

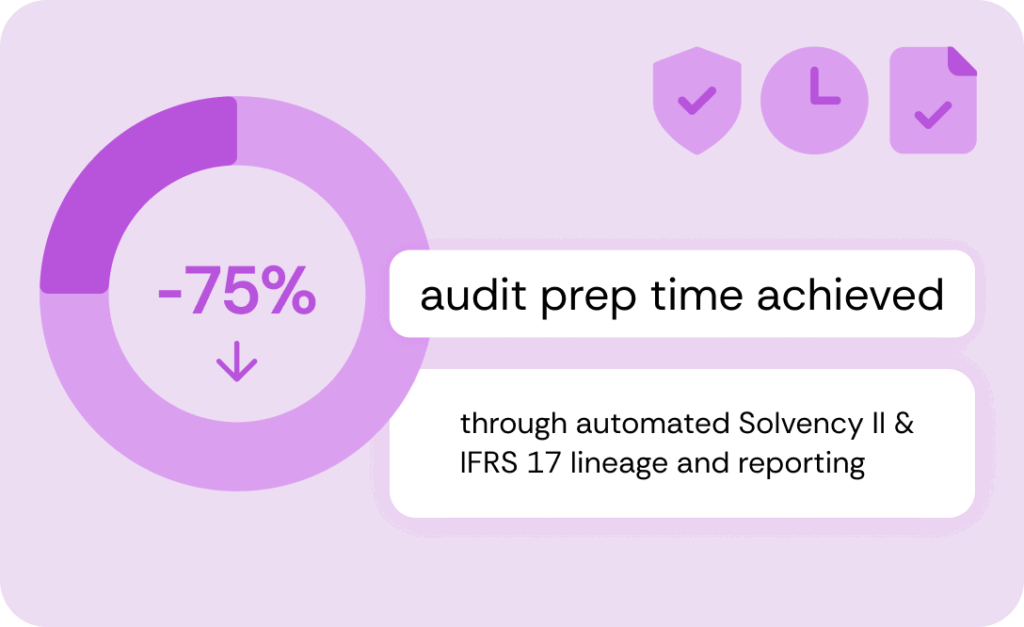

Automate the steps needed for Solvency II, IFRS 17 data lineage and reporting, and internal management reporting by leveraging built-in end-to-end row-level lineage and auditing that can be used for any reporting.

Up to 50x faster partner and agency onboarding, from months to days

10x greater productivity and self-service, no-code integration

Connects to anything including Guidewire, Duck Creek, ISO, Sapiens, and legacy systems

Real-Time and batch processing from files and daily loads to real-time APIs and streaming

No-code transforms powered by AI and built-in insurance logic (ACORD, Xchanging)

Supports all integration patterns needed for AI, analytics, B2B and operations

HIPAA, GDPR, and SOC 2 certified with end-to-end lineage and audit trails

2-5x lower costs compared to the alternatives

“We cut data onboarding time from weeks to hours for brokers and open enrollments, accelerating our time-to-revenue and improving agent satisfaction.”

“Achieved straight-through processing for 80% of simple claims in unstructured formats, freeing our adjusters to focus on complex cases requiring human expertise.”

We have scaled up from 2 users to 20+ users and processing has gone up from 10 files to 10000+ files every month and have had no critical concerns. Big kudos to the Customer experience team for always being available and providing detailed solutions.”

A top U.S. insurance provider offering claims services across affiliate carriers, OEM partnerships, and insurtech needed to modernize its data infrastructure to improve onboarding and claims processing, especially to handle non-traditional and 3rd-party policies.