I’ve been watching the Fivetran-dbt merger reaction for the past few weeks.

And honestly? The gap between what the press releases say and what’s actually happening is wild.

The companies promise “open data infrastructure” and “AI-ready foundations.”

The market says something very different.

Let’s Talk About What’s Really Going On

Reddit exploded. 80+ comments in 48 hours. LinkedIn got skeptical fast. And the investors? They’re doing math that doesn’t quite add up.

This isn’t about whether Fivetran or dbt are good companies. They are.

This is about what happens when two point solutions merge because they’re losing to platform vendors. And what that means for you.

Let me break it down.

The Analyst Take: “This Is Defensive”

Rob Strechay from theCUBE Research said something interesting: “Both pieces are becoming more critical as data platforms and AI meet use cases requiring clear ROI.”

Notice what he didn’t say?

That this merger creates something new.

One consultant was more direct on LinkedIn: “Databricks is eating the world with its one-stop-shop. This is scrambling to catch up.”

Here’s the thing:

Can two separate products (that will stay separate) compete with Databricks offering everything in one platform?

Or Snowflake doing the same?

History says no. Data infrastructure M&A shows:

- 68% of customers hit service disruptions post-merger

- 73% see price increases within 18 months

- 54% report slower innovation

Why would this be different?

If You’re on Snowflake or Databricks, This Gets Interesting

Your vendor landscape just shifted. Not in your favor.

Your Platform Vendor Just Got Stronger

Within two weeks of the merger, Databricks held analyst briefings. The message was clear: “Why piece together Fivetran + dbt when everything works better integrated?”

Snowflake did the same.

And you know what? They’re right.

Your negotiating position just weakened.

Before, you could say “we prefer best-of-breed tools like Fivetran and dbt.” That was credible.

Now? Platform vendors are pushing: “Why pay separately when we include it?”

One VP said: “Our Snowflake rep called within days. The pitch was: ‘With the Fivetran-dbt uncertainty, now’s a great time to consolidate.’ We’re having that conversation.”

The Double Squeeze

Here’s what’s happening to your budget:

From Fivetran-dbt: March 2025 – some customers saw 4-8x price increases. Post-merger? Expect bundling pressure and more increases.

From your platform vendor: They’re using the merger to justify bundling everything. “Why pay extra when we include it?”

The result? Your costs potentially go up from both sides.

This is not theoretical. This is happening right now to teams we talk to.

What Smart Teams Are Doing

Path 1: All-in on platform native: Use Databricks or Snowflake for everything. Single vendor. Tighter integration. Potentially lower cost.

The downside? Ultimate lock-in. If they raise prices next year, you have zero leverage.

Path 2: Stick with Fivetran-dbt: Keep your external tools. Maintain some independence.

The downside? Higher costs. Pricing risk. Platform vendors may start deprioritizing integration with external tools.

Path 3: Build for independence: This is what most folks who want flexibility are doing.

A financial services firm we know built on a vendor-independent platform. They can run on Databricks or Snowflake.

They used that optionality to negotiate 40% off their Databricks renewal.

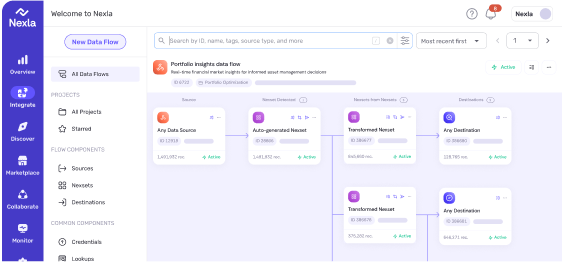

A healthcare company decided: “We want Snowflake focused on being the best warehouse, not everything.” They kept Snowflake for compute, but added an independent integration layer like Nexla.

The pattern? They’re not locked into anyone’s roadmap or pricing.

What Actual Users Are Saying

This is where it gets real. Because practitioners don’t hold back on Reddit.

The r/dataengineering thread hit 80+ comments fast:

“Core is gonna stay unchanged while Cloud keeps gaining new features. Eventually, end-of-life.” [47 upvotes]

“The anger is real when someone’s open source baby gets murdered by a SaaS vendor.” [62 upvotes]

“Fivetran raised prices 4-8x. Now they’re acquiring dbt. You don’t need a crystal ball.” [55 upvotes]

“dbt pricing going to the moon.” [43 upvotes]

The most upvoted comment: “This is defensive, not offensive.” [73 upvotes]

LinkedIn was more professional but equally skeptical.

Jennifer Stirrup wrote: “Combining ingestion and transformation increases convenience, but also vendor lock-in. Enterprises need to re-evaluate their vendor exposure.”

1,200+ reactions. 150+ comments agreeing.

One VP: “We’re evaluating alternatives now, before our leverage disappears. Our renewal is in 8 months. That’s our window.”

Nobody’s celebrating this except the people announcing it.

The Investor Math Doesn’t Add Up

Both companies are backed by big VCs. The all-stock deal tells you something: neither could hit their growth targets alone.

Here’s the math problem:

They have ~$600M ARR combined. To justify a $10B+ exit (what VCs need), they need $2-3B ARR.

That’s 3-5x growth.

In a market where:

- Both were already stalling (hence the merger)

- Platform vendors bundle competing features

- 80-90% of their customers overlap (minimal cross-sell opportunity)

How do they get there?

Cost synergies help. Maybe $50-100M annually.

But that’s not growth. That’s efficiency.

This merger avoids the downside (becoming irrelevant) more than capturing upside (winning the market).

Late-stage investors who paid $4-5B valuations? They’re not getting cash. They’re getting equity in a combined entity with uncertain returns.

Not a disaster. But not the 5x they signed up for.

Five Things This Merger Tells Us

- The modern data stack is dead

Best-of-breed assembly is over. Customers want platforms, not point solutions.

- Pricing power is shifting

Fivetran’s 4-8x increase woke customers up. Now they’re evaluating alternatives and building for flexibility.

- Open source is under pressure

Corporate-controlled “open source” becomes proprietary when business needs change. We’ve seen it with HashiCorp, Elastic, MongoDB, Redis. Now dbt Core concerns.

- AI is the real battlefield

Both companies justify this with “AI-ready infrastructure.” But neither was built for AI workloads. Real AI winners? Purpose-built platforms with native RAG and vector databases.

- The VC model is under stress

When organic growth stalls, you merge to manufacture momentum. But combining companies with 80-90% overlap doesn’t create new growth. It consolidates existing revenue.

What You Should Watch For

The merger won’t close for 6-12 months. Here’s how to tell if this is going well or badly:

Green flags:

- Major dbt Core releases with real features

- Transparent roadmap

- Pricing commitments for existing customers

Red flags:

- dbt Core updates slow to quarterly

- “Cloud exclusive” features

- Support quality declining

- Key people leaving

Actions reveal intentions. The first year tells you everything.

Here’s What Could Happen

This merger probably doesn’t work.

Not because these are bad companies. But because merging two point solutions doesn’t create a platform.

Technical integration will be harder than expected. The culture clash (open source dbt meets proprietary Fivetran) will be messy. Pricing coordination will frustrate customers.

Meanwhile, Databricks and Snowflake keep building.

Best case: Modest synergies. Stable market position. Survival without thriving.

Worst case: Integration bogs down. Talent leaves. Customers defect.

Most likely: Somewhere in between. Higher prices. Slower innovation. Some value created, some destroyed.

In 2-3 years, we’ll probably say “that worked out okay, but not great.”

Your Window Is Now

Before this merger closes and new pricing kicks in, you have leverage.

Use it.

If you’re staying:

- Lock in multi-year terms now

- Get price protection clauses in writing

- Secure exit provisions

If you’re evaluating:

- Build proof-of-concepts with alternatives. Nexla offers a free migration and favorable contract buy-out terms.

- Document your true costs (not just license fees)

- Create architectural flexibility

If you’re on Snowflake or Databricks:

- Reassess your native vs. external tool strategy

- Build vendor-independent data products

- Keep negotiating leverage with your platform vendor

The teams who act now will protect themselves.

The teams who wait will accept whatever terms they’re offered.

Bottom Line

Vendor changes are exhausting. You have actual work to do.

But here’s the thing:

The market just told you something important. Two major vendors merged defensively because they couldn’t compete alone. Platform vendors are using this to push bundling. Customers are worried about pricing and lock-in.

This is your signal to act.

Not panic. Not rip everything out.

Just reassess. Evaluate. Build in some flexibility.

Because when vendors have you locked in, they exercise pricing power.

Always.

The market has spoken.

What are you going to do about it?