Transforming Data Integration in the Insurance Industry

The insurance industry is under pressure to modernize. Amid evolving customer expectations, rising regulatory complexity, and an explosion of digital channels, insurers must manage vast volumes of data flowing in from a wide range of internal systems, business units, and third-party partners.

But the reality for many insurers is messy: inconsistent formats, legacy data pipelines, manual integrations, and disconnected spreadsheets slow everything from agent and partner onboarding to claims processing. For growing organizations, each new business unit, carrier, or partner adds more strain to already overstretched data teams.

At Nexla, we’re helping insurance companies turn this complexity into a competitive advantage.

The Data Challenge in Insurance

Insurance companies rely on accurate, timely data to:

- Onboard new partners and agencies

- Make policy and claims decisions and processing faster

- Ensure agents are authorized to sell and discount insurance packages

- Uncover insights for underwriting and risk assessment

- Deliver personalized experiences to policyholders

To support these efforts, insurers often depend on tools like Tableau and Power BI for business intelligence, Snapsheet for digital claims management, and emerging systems like Pinecone for vector-based search and retrieval in AI-driven workflows.

But doing all this at scale—especially in an ecosystem with fragmented formats like CSV, Excel, PDFs, APIs, and legacy systems—is anything but simple. As a result, insurers face challenges like:

- Revenue loss from onboarding cycles that take 4–6 weeks instead of days for new business units or affiliates due to manual data pipeline creation

- Complexities and delays due to inefficiencies in managing data variety—from outdated and unstructured documents, SharePoints, to custom carrier exports

- Compliance concerns, where data must remain siloed between entities, affiliates, or lines of business

Depleting morale among data teams due to growing backlogs, rigid tooling, and brittle custom code that’s hard to maintain

How Nexla Solves It

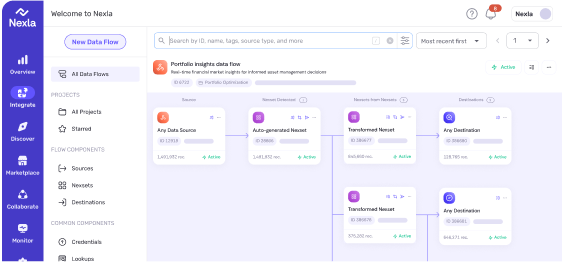

Nexla helps insurers overcome these challenges with a modern, enterprise-grade AI integration platform that is both powerful and flexible.

Faster Growth and Revenue from Fast, Scalable Onboarding

With Nexla, onboarding new data sources is reduced from weeks to days. Smart connectors and a no-code interface allow both technical and business users to rapidly integrate new business units, carriers, or partners—regardless of the format or system. Whether connecting to legacy claims systems, Snapsheet, or third-party APIs, Nexla simplifies the process.

Unifying Data to Common Data Model with Nexsets

Nexla automatically transforms incoming data into a common data model via Nexsets—human-readable, structured, reusable, and AI-ready data products. This makes it easy to build canonical models across diverse sources, enabling consistent analytics in Tableau/Power BI, regulatory reporting, and even powering downstream AI systems like Pinecone.

Empowering Back Office Productivity with Built-In AI & RAG Capabilities

Nexla’s agentic AI framework and designer enables insurers to quickly build retrieval-augmented generation (RAG) workflows. Teams can query policy documents or claims data using natural-language prompts and get precise, actionable answers—dramatically reducing manual review time and boosting productivity.

Self-Service with Enterprise-Grade Data Governance

From automated monitoring to tenant-level isolation, Nexla ensures compliance and control at every step. Organizations can confidently integrate and process sensitive data across subsidiaries, partners, and systems—including integrations with platforms like Power BI—without compromising security or auditability.

Real-World Success

A prominent insurer offering third-party claims services across affiliate carriers and OEM partnerships needed to modernize how it handled inbound and outbound claims data. With multiple external partners sending files in unique formats and a growing backlog of manual integrations, the team struggled to scale.

Implementing Nexla, our customers in the insurance space have:

- Reduced partner onboarding time by 3x, standardizing data ingestion across hundreds of business units and carriers

- Automated 60–70% of manual tasks and improved claims efficiency by 30%

- Established data isolation and governance per affiliate or partner

- Empowered teams to generate insights with natural-language queries, enabling better insurance quotes and accelerating time-to-value across BI platforms like Tableau

Conclusion

In a data-driven industry like insurance, the ability to move fast and stay in control is no longer optional. Nexla makes it possible to integrate, transform, and deliver data with unmatched speed and reliability—so insurers can focus on growth, innovation, and customer experience.

If you’re ready to eliminate manual pipelines, reduce onboarding timelines, and prepare your data infrastructure for the future, Nexla can help.

Contact us to learn more or watch our latest webinar to see these stories in action.